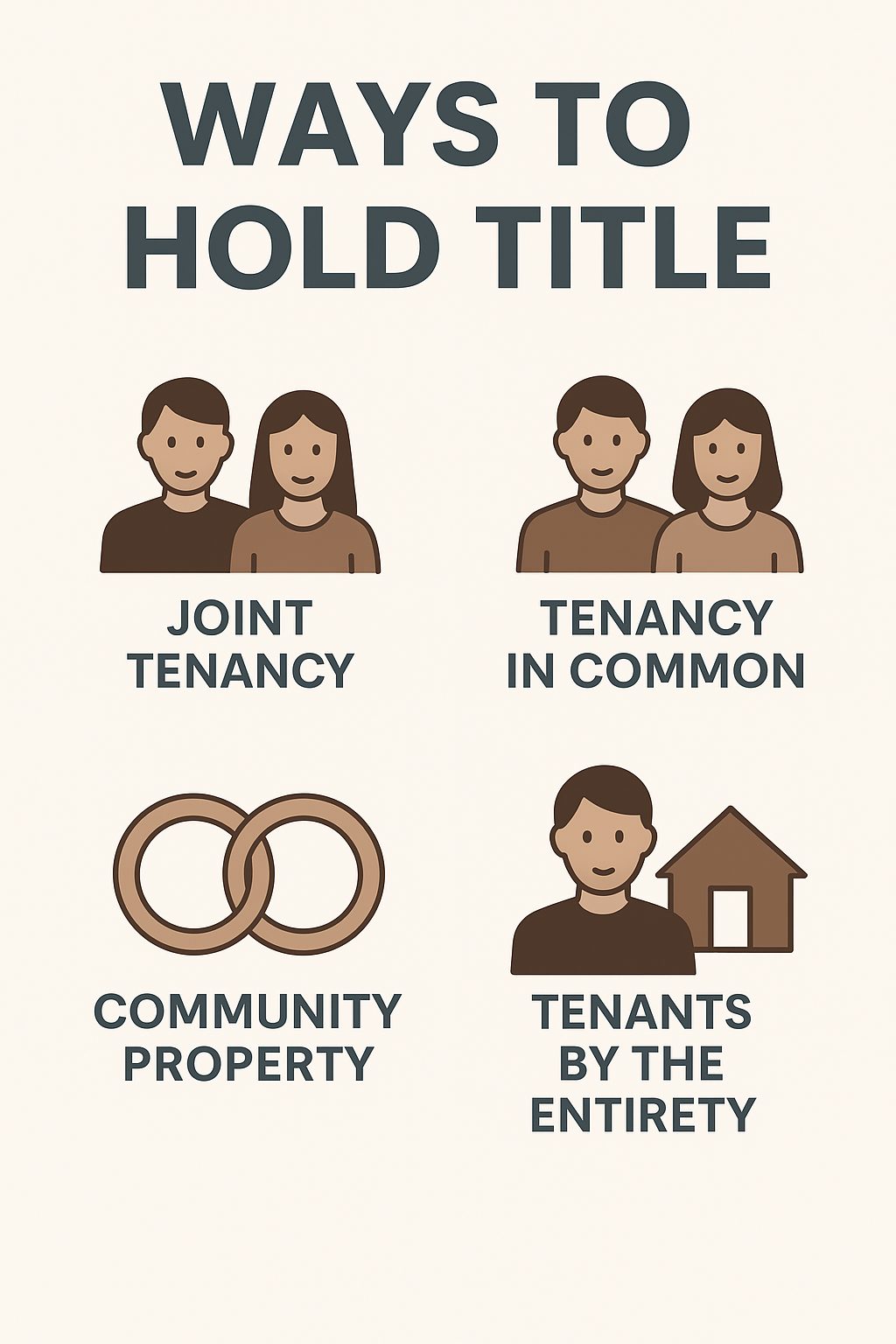

Different Ways a Married Couple Can Hold Title in Real Estate

When a married couple purchases a home, one of the most important — and often overlooked — decisions they’ll make is how to hold title to the property. The way title is held affects ownership rights, inheritance, and potential tax implications. Here’s a breakdown of the most common ways married couples can hold title in real estate, particularly in California and similar community property states.

1. Community Property

In community property states like California, any property acquired during marriage is presumed to be owned equally by both spouses. This means each spouse owns 50% of the property, regardless of who earned the income or signed the purchase documents.

Pros:

- Equal ownership rights.

- Clear rules for dividing assets in the event of divorce.

Cons: - Without additional provisions, the deceased spouse’s share must go through probate.

2. Community Property with Right of Survivorship

This option combines the benefits of community property with the simplicity of avoiding probate. When one spouse passes away, the surviving spouse automatically becomes the sole owner.

Pros:

- Avoids probate.

- Maintains community property tax benefits, including a full step-up in basis upon the death of one spouse.

Cons: - Not as flexible for estate planning involving children or trusts.

3. Joint Tenancy with Right of Survivorship

In joint tenancy, both spouses own equal shares of the property, and when one dies, the surviving spouse automatically inherits the other’s share.

Pros:

- Bypasses probate.

- Simple and common method for married couples.

Cons: - Does not provide the same tax benefits as community property.

- Each spouse’s share can be affected by creditors or separate legal judgments.

4. Tenancy in Common

This method allows each spouse to own a specific percentage of the property, which doesn’t have to be equal. Each owner’s share can be sold, gifted, or passed down to heirs independently.

Pros:

- Flexibility in ownership shares and inheritance.

- Useful for blended families or business partnerships.

Cons: - No right of survivorship — the deceased spouse’s share must go through probate.

5. Holding Title in a Living Trust

A couple can also hold title through a revocable living trust, which allows for seamless management and transfer of property upon death or incapacity.

Pros:

- Avoids probate.

- Offers flexibility and privacy.

- Can include customized inheritance instructions.

Cons: - Requires proper setup and ongoing maintenance.

Final Thoughts

Choosing how to hold title is more than just a paperwork detail — it can have long-term consequences for taxes, inheritance, and ownership rights. Because every couple’s financial and family situation is unique, it’s always wise to consult with a real estate attorney, tax advisor, or estate planning expert before deciding how to take title. The right choice today can help prevent costly legal complications tomorrow.

Steve Cardinalli

Real Estate Professional, 01323509

(760) 814-0248

Steve@Cardinalli.com

www.Cardinalli.com

Century 21 Affiliated Fine Homes & Estates

Village Faire in Carlsbad Village

300 Carlsbad Village Dr, 223

Carlsbad, CA 92008

Be the first to know about the market trend in your community at Neighborhood News

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link