If you own property in San Diego County and believe the assessed value is too high, here are the main steps and options you can use to try to reduce your property’s value (and thus your taxes). I’ll walk you through the process and things to consider.

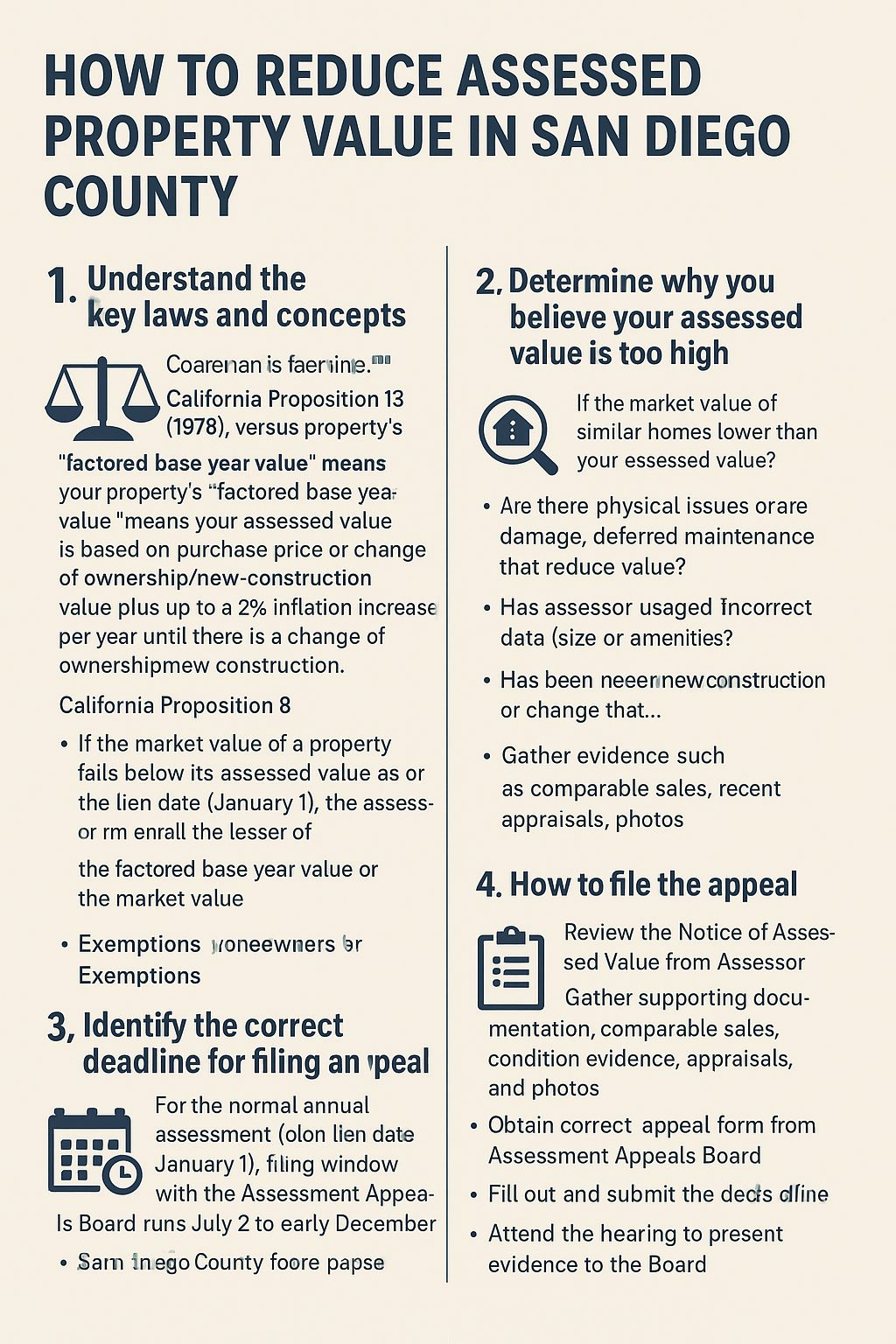

✅ 1. Understand the key laws and concepts

- Under California Proposition 13 (1978): your property’s “factored base year value” means your assessed value is based on the purchase price (or change of ownership/new‐construction value) plus up to a 2% inflation increase per year (until there is change of ownership/new construction).

- Under California Proposition 8: if the market value of your property falls below your assessed value as of the lien date (January 1), the assessor must enroll the lesser of (a) the factored base year value or (b) the market value.

- This means you can request a “decline in value” review.

- In San Diego County:

- You can appeal the assessment with the Assessment Appeals Board of San Diego County.

- You also can ask the assessor informally for reconsideration.

- Exemptions: e.g., the Homeowners’ Exemption gives a $7,000 reduction in taxable value for a principal residence.

📝 2. Determine why you believe your assessed value is too high

Ask yourself questions like:

- Is the market value of similar homes lower than my assessed value?

- Are there physical issues with my property (damage, deferred maintenance) that reduce value?

- Did the assessor use incorrect data (incorrect size, amenities, etc.)?

- Has there been new construction or change that concerned me?

You’ll need evidence: comparable sales, recent appraisals, photos, etc.

📆 3. Identify the correct deadline for filing an appeal

- For the normal annual assessment (lien date January 1), in San Diego County the filing window with the Assessment Appeals Board runs typically from July 2 to December 1 (or early December).

- For a supplemental assessment (e.g., after a change of ownership or new construction), if you receive a supplemental bill you must file within 60 days of that bill or notice.

📄 4. How to file the appeal

Here’s a step-by-step outline for San Diego County:

- Review your Notice of Assessed Value from the San Diego County Assessor/Recorder/County Clerk and make sure all the data is correct.

- Gather supporting documentation: comparable sales, condition evidence, appraisal, photos.

- Obtain the correct appeal form: see the forms page for the Assessment Appeals Board.

- Fill the form out and submit it (mail or in person) by the deadline. For example: mail to “Clerk of the Board of Supervisors, Assessment Appeals, 1600 Pacific Highway, Room 402, San Diego, CA 92101‐2471”.

- Attend your hearing: you will present your evidence to the Board. The Board may reduce, affirm, or increase the assessment (though if you’re appealing typically you hope for a reduction).

🚩 5. Tips to improve your chances

- Make sure you compare to similar properties (location, size, age, condition).

- Emphasize things that reduce market value (damage, obsolescence, lot problems).

- Make sure there are no errors in the assessor’s records (square footage, number of bedrooms, amenities).

- Consider discussing the value with an appraiser ahead of time.

- Be timely – missing deadlines will disqualify you.

- Stay calm and factual at the hearing—focus on market value evidence.

Steve Cardinalli

Real Estate Professional, 01323509

(760) 814-0248

Steve@Cardinalli.com

www.Cardinalli.com

Century 21 Affiliated Fine Homes & Estates

Village Faire in Carlsbad Village

300 Carlsbad Village Dr, 223

Carlsbad, CA 92008

Be the first to know about the market trend in your community at Neighborhood News

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link