Due Diligence Fees in California Real Estate: What Buyers and Sellers Need to Know

When purchasing a home in California, buyers encounter a variety of terms, timelines, and costs—many of which can feel overwhelming. One that often causes confusion is the “due diligence fee.” While common in other states, especially in the Southeast, due diligence fees are not formally defined in California contracts. However, the concept of due-diligence-related costs absolutely exists here.

Let’s break down what “due diligence fees” mean in California real estate and how they affect both buyers and sellers.

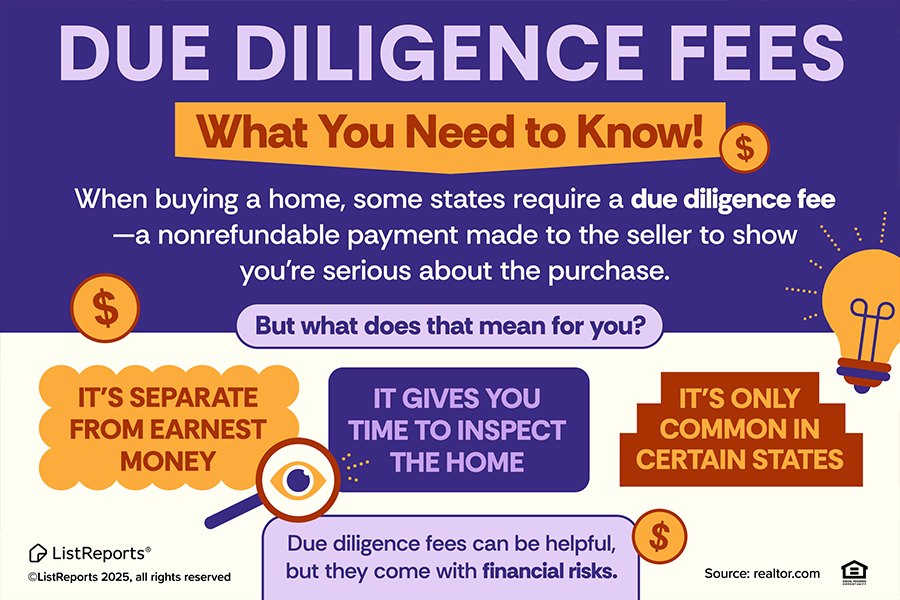

What Is a Due Diligence Fee?

In some states, a due diligence fee is a non-refundable payment from the buyer to the seller, made upfront, giving the buyer the right to investigate the property before moving forward with the purchase.

California does not use this exact system.

However, California’s standard contracts include earnest money deposits and contingency periods, which together function similarly to due diligence fees—just structured differently.

California’s Version of a “Due Diligence Fee”

Instead of paying a non-refundable fee directly to the seller, California buyers typically pay:

1. Earnest Money Deposit (EMD)

This is the buyer’s good-faith deposit, usually 1–3% of the purchase price, held in escrow—not given to the seller.

It becomes refundable or nonrefundable based on the buyer’s contingencies.

2. Inspection and Due Diligence Costs

While not paid to the seller, these costs are part of the buyer’s “due diligence” process and include:

- Home inspections

- Termite/pest inspections

- Roof inspections

- Sewer line or septic inspections

- Hazard reports

- Appraisals

- Specialized contractor evaluations

These fees are paid out of the buyer’s pocket during the contingency period. They are generally non-refundable, even if the buyer cancels.

Contingency Periods: The Core of Due Diligence in California

California buyers rely on contingencies rather than due diligence fees.

The major contingencies include:

- Inspection contingency (typically 7–17 days)

- Appraisal contingency

- Loan contingency

- Disclosure review period

During these windows, buyers can investigate the home thoroughly.

If the buyer cancels during an active contingency, the earnest money deposit is protected.

Once the buyer removes contingencies, the EMD becomes at risk—this is the closest parallel to the “nonrefundable due diligence fee” in other states.

Are Sellers Allowed to Ask for a Due Diligence Fee in California?

Yes—but it’s extremely uncommon and must be mutually agreed upon.

A seller could theoretically request:

- A nonrefundable deposit,

- A buyer-paid option fee, or

- A pre-negotiated credit to the seller for taking the property off the market.

However, because California’s contracts are contingency-based, buyer agents typically advise against making nonrefundable payments unless the buyer has a strong reason—such as winning a highly competitive multiple-offer situation.

How Buyers Benefit from California’s System

California’s contingency approach protects buyers by:

- Allowing withdrawal from the deal if issues arise

- Protecting the earnest money until contingencies are removed

- Providing time for inspections, appraisals, and document review

- Avoiding nonrefundable upfront fees

Buyers can investigate without fear of immediately losing money to the seller.

How Sellers Benefit

Sellers can still protect themselves by:

- Limiting contingency periods

- Requesting strong EMD amounts

- Asking for proof of funds

- Reviewing preapproval letters

- Encouraging buyers to shorten contingency timelines in competitive markets

A seller can even request a nonrefundable deposit, though it must be disclosed, negotiated, and agreed to in writing.

Final Thoughts

While California does not formally use “due diligence fees” the way other states do, the combination of earnest money deposits, contingency periods, and buyer-paid inspections functions as California’s equivalent.

For buyers, this system provides protection and flexibility.

For sellers, it offers structure and seriousness from the buyer—especially once contingencies are removed.

Understanding this structure is essential for navigating California’s unique real estate landscape smoothly and confidently.

Steve Cardinalli

Real Estate Professional, 01323509

(760) 814-0248

Steve@Cardinalli.com

www.Cardinalli.com

Century 21 Affiliated Fine Homes & Estates

Village Faire in Carlsbad Village

300 Carlsbad Village Dr, 223

Carlsbad, CA 92008

Be the first to know about the market trend in your community at Neighborhood News

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link