Proposed Documentary Transfer Tax (DTT) Increase in San Diego: What It Could Mean for the Real Estate Market

San Diego is considering a significant change to the Documentary Transfer Tax (DTT)—a fee paid when real property changes ownership. While still a proposal, the potential increase has generated strong opinions across the real estate community due to its possible impact on sellers, buyers, investors, and overall market activity.

Understanding how the DTT works—and how the proposed increase differs from the current structure—is critical for anyone considering a real estate transaction in San Diego.

What Is the Documentary Transfer Tax?

The Documentary Transfer Tax is a one-time tax assessed at the transfer of property ownership, typically calculated based on the sales price. In most San Diego transactions, the tax is customarily paid by the seller, although it can be negotiated in the purchase agreement.

DTT revenue is generally allocated to local government services, which may include infrastructure, housing programs, or general fund expenses.

Current Rate vs. Proposed Increase

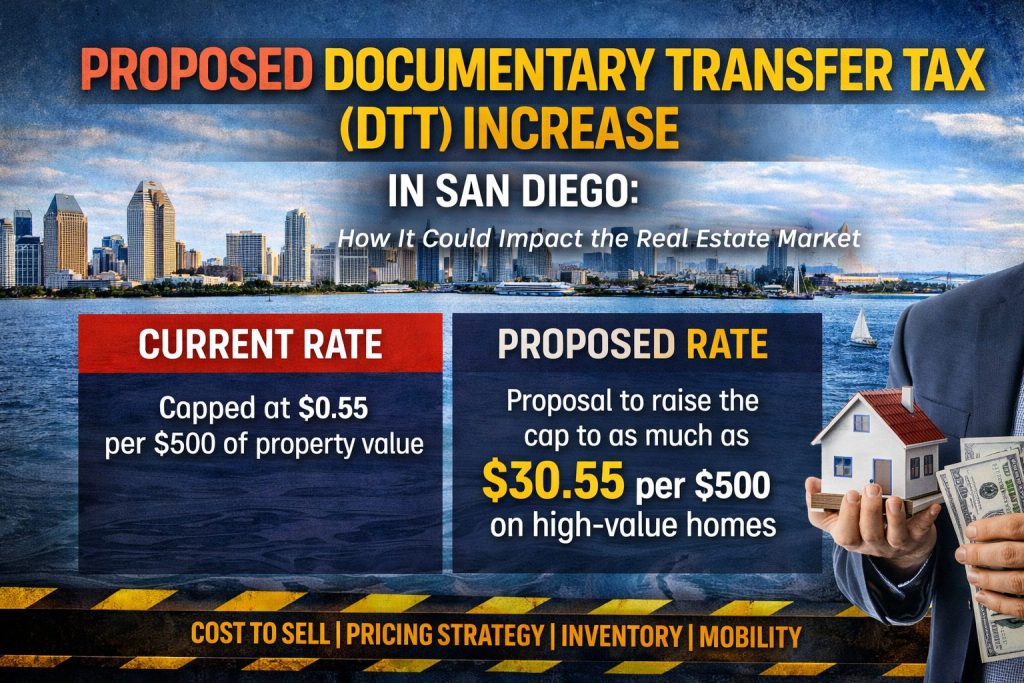

Under the existing framework:

- Current Rate: The DTT is capped at $0.55 per $500 of property value.

Under the proposal being discussed:

- Proposed Rate: The cap could increase to as much as $30.55 per $500 of property value on high-value homes.

If approved, this would represent a substantial increase in transaction costs for qualifying properties, applied only at the time of sale, not annually like property taxes.

Potential Impact on Sellers

Higher Cost to Sell

A higher DTT directly increases seller closing costs. On higher-priced homes, the proposed rate could result in significantly higher taxes due at closing, potentially reaching tens of thousands of dollars.

Changed Selling Strategies

Sellers may respond by:

- Increasing listing prices to offset the tax

- Becoming less flexible during negotiations

- Delaying sales until market or policy conditions change

This could contribute to reduced housing inventory, particularly in higher price brackets.

Potential Impact on Buyers

Although buyers don’t typically pay the DTT directly, the cost rarely disappears:

- Sellers may price homes higher

- Fewer listings could increase competition

- Negotiations may become tighter

Over time, this can place upward pressure on prices, especially in desirable neighborhoods.

Effects on Investors and Luxury Properties

High-value homes and investment properties are expected to be the most affected.

- Reduced profit margins for investors

- Fewer flips and speculative transactions

- Potential redirection of capital to nearby markets with lower transaction costs

This could slow transaction volume in certain segments without necessarily improving affordability.

Housing Affordability: Help or Hindrance?

Supporters argue that increased DTT revenue could fund affordable housing initiatives. Critics point out that higher transaction costs are often passed along, potentially increasing prices or limiting mobility.

In real estate, added costs are rarely absorbed without consequence—they usually shift elsewhere in the market.

Broader Market Implications

If implemented, a higher DTT could lead to:

- Fewer overall transactions

- Longer homeowner hold periods

- Reduced market mobility

- Short-term slowdowns in higher price tiers

While markets tend to adjust over time, policy changes like this can create near-term friction.

The Real Estate Takeaway

The proposed increase to San Diego’s Documentary Transfer Tax underscores how local policy decisions can directly affect real estate behavior. Whether you’re planning to buy, sell, or invest, understanding how transaction costs factor into timing and pricing decisions is more important than ever.

As the proposal continues to evolve, details such as price thresholds, exemptions, and implementation timelines will be critical.

Steve Cardinalli

Real Estate Professional, 01323509

(760) 814-0248

Steve@Cardinalli.com

www.Cardinalli.com

Century 21 Affiliated Fine Homes & Estates

Village Faire in Carlsbad Village

300 Carlsbad Village Dr, 223

Carlsbad, CA 92008

Be the first to know about the market trend in your community at Neighborhood News

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link