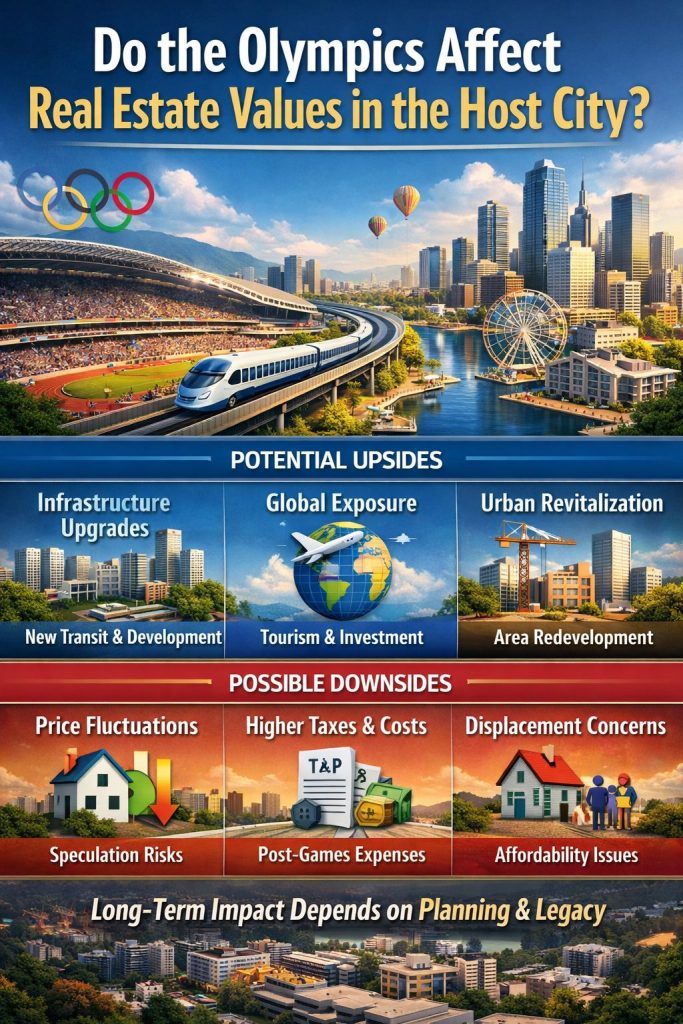

Do the Olympics Affect Real Estate Values in the Host City?

When a city is selected to host the Olympic Games, the spotlight turns global almost overnight. Billions of viewers tune in, massive infrastructure projects break ground, and investors begin asking the same question: What does this mean for real estate values?

The short answer is yes—the Olympics can impact real estate prices—but the effect is far more nuanced than a simple surge in home values. Let’s break down how the Olympics typically influence a host city’s housing market.

How the Olympics Can Boost Property Values

Infrastructure Investment

Host cities often invest heavily in transportation, public spaces, and utilities in preparation for the Games. New rail lines, upgraded highways, airport improvements, and revitalized neighborhoods can create lasting value—especially for properties near these enhancements. Homes with improved access to transit and amenities often see stronger long-term appreciation.

Global Exposure and Tourism

The Olympics put a city on the world stage. This exposure can elevate the city’s international reputation, attract foreign buyers, and fuel long-term tourism growth. In many host cities, this has increased demand for centrally located homes, condominiums, and short-term rental properties.

Urban Revitalization

Many cities use the Olympics as a catalyst to redevelop underutilized or neglected areas. When these projects are well-planned and supported after the Games, surrounding neighborhoods may experience above-average appreciation in the years that follow.

Potential Downsides to Watch For

Short-Term Price Spikes

Speculation often pushes prices higher leading up to the Olympics. However, in some cases, values level off—or even dip—once the event ends and the hype fades. Not every Olympic bump translates into long-term growth.

Higher Taxes and Public Costs

Hosting the Olympics is expensive. Cities sometimes face budget shortfalls afterward, which can lead to higher taxes or reduced public spending—factors that may weigh on housing demand in certain areas.

Policy and Housing Pressure

Rapid redevelopment can raise concerns about affordability and displacement. In response, some cities implement rent controls or stricter housing regulations, which can limit future appreciation or investor returns.

Timing Is Everything

- Before the Olympics: Development activity and investor speculation often drive prices upward.

- During the Olympics: Short-term rental demand typically spikes.

- After the Olympics: Long-term value depends on whether new infrastructure and venues continue to serve the community.

Cities with strong post-Olympic plans—such as Barcelona after 1992 or London after 2012—tend to see lasting benefits. Others struggle if facilities are underused once the Games are over.

The Bottom Line

The Olympics can positively impact real estate values, but the benefits are usually localized, strategic, and long-term. Properties near permanent infrastructure improvements and revitalized districts tend to benefit the most, while speculative gains alone can be risky.

As future host cities like Los Angeles 2028 prepare for the Games, the real opportunities will likely come from smart urban planning, improved transit corridors, and neighborhoods positioned for sustained growth—long after the Olympic flame is extinguished.

Steve Cardinalli

Real Estate Professional, 01323509

(760) 814-0248

Steve@Cardinalli.com

www.Cardinalli.com

Century 21 Affiliated Fine Homes & Estates

Village Faire in Carlsbad Village

300 Carlsbad Village Dr, 223

Carlsbad, CA 92008

Be the first to know about the market trend in your community at Neighborhood News

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link