How the Recent Interest Rate Reduction Impacts Buyers and Sellers

After a long stretch of elevated mortgage rates, the recent reduction in interest rates is beginning to reshape the real estate landscape. While rates are still higher than the historic lows of a few years ago, even a modest drop can have meaningful effects on both buyers and sellers. Here’s how the shift is playing out across the market.

What Lower Rates Mean for Buyers

1. Improved Affordability

A lower interest rate directly reduces a buyer’s monthly mortgage payment. Even a small rate decrease can translate into hundreds of dollars saved each month, increasing overall purchasing power.

2. Expanded Buying Options

With improved affordability, buyers may qualify for higher-priced homes or feel more comfortable choosing properties that previously stretched their budgets. This can reopen neighborhoods or home styles that were recently out of reach.

3. Renewed Buyer Confidence

Many buyers paused their plans during periods of rate volatility. Rate reductions often bring buyers back off the sidelines, increasing showing activity and loan applications.

4. Competitive Pressure Returns

As more buyers re-enter the market, competition can increase—especially for well-priced, move-in-ready homes. Buyers may need to act more decisively and be prepared with strong offers.

What Lower Rates Mean for Sellers

1. Larger Buyer Pool

Lower rates expand the number of qualified buyers, which can lead to increased demand for listings—particularly in desirable price ranges.

2. Stronger Offers

With buyers saving on financing costs, sellers may see cleaner offers with fewer concessions, stronger down payments, or shorter contingencies.

3. Improved Market Momentum

Rate reductions often boost market activity overall, reducing days on market and improving seller confidence.

4. Pricing Discipline Still Matters

While demand may increase, today’s buyers remain price-conscious. Homes that are overpriced or poorly presented may still sit, even in a lower-rate environment.

The “Lock-In” Effect Begins to Ease

One major challenge over the past two years has been the so-called “lock-in effect,” where homeowners with ultra-low mortgage rates were reluctant to sell. As rates come down, some of that hesitation begins to fade, potentially leading to more inventory and better balance between supply and demand.

What This Means for the Market Overall

- More transactions as buyers and sellers find common ground

- Moderate price stability, rather than dramatic spikes or drops

- Increased negotiation, especially as inventory gradually improves

This rate reduction doesn’t signal a return to the frenzied markets of the past, but it does point toward a healthier, more active real estate environment.

Bottom Line

Lower interest rates are a positive development for both buyers and sellers—but strategy still matters. Buyers should focus on long-term affordability, not just monthly payments, while sellers should price and present their homes thoughtfully to capture renewed demand.

Whether you’re considering buying, selling, or just watching the market, understanding how rate changes affect real estate can help you make smarter, more confident decisions.

Steve Cardinalli

Real Estate Professional, 01323509

(760) 814-0248

Steve@Cardinalli.com

www.Cardinalli.com

Century 21 Affiliated Fine Homes & Estates

Village Faire in Carlsbad Village

300 Carlsbad Village Dr, 223

Carlsbad, CA 92008

Be the first to know about the market trend in your community at Neighborhood News

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

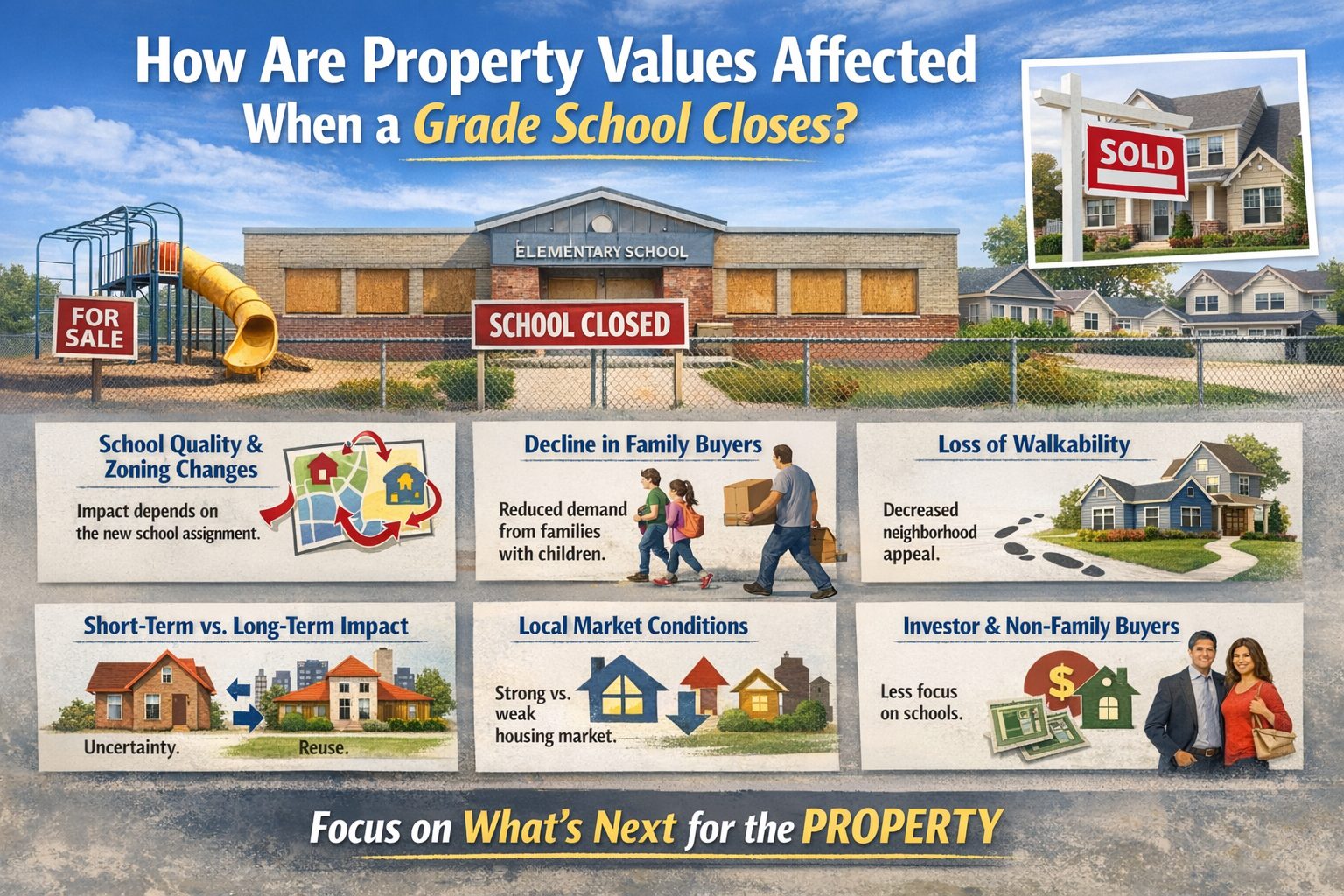

The short answer: not directly—but it can influence perception, and in real estate, perception matters.

The short answer: not directly—but it can influence perception, and in real estate, perception matters.