The History of Front Doors: From Fortress Gates to Modern Design Statements

The front door has always been more than just an entryway—it’s a symbol of protection, hospitality, and identity. Over thousands of years, this simple structure has evolved from heavy barriers designed for defense to architectural focal points that reflect personal style and cultural heritage. Here’s a look at how front doors have transformed through history.

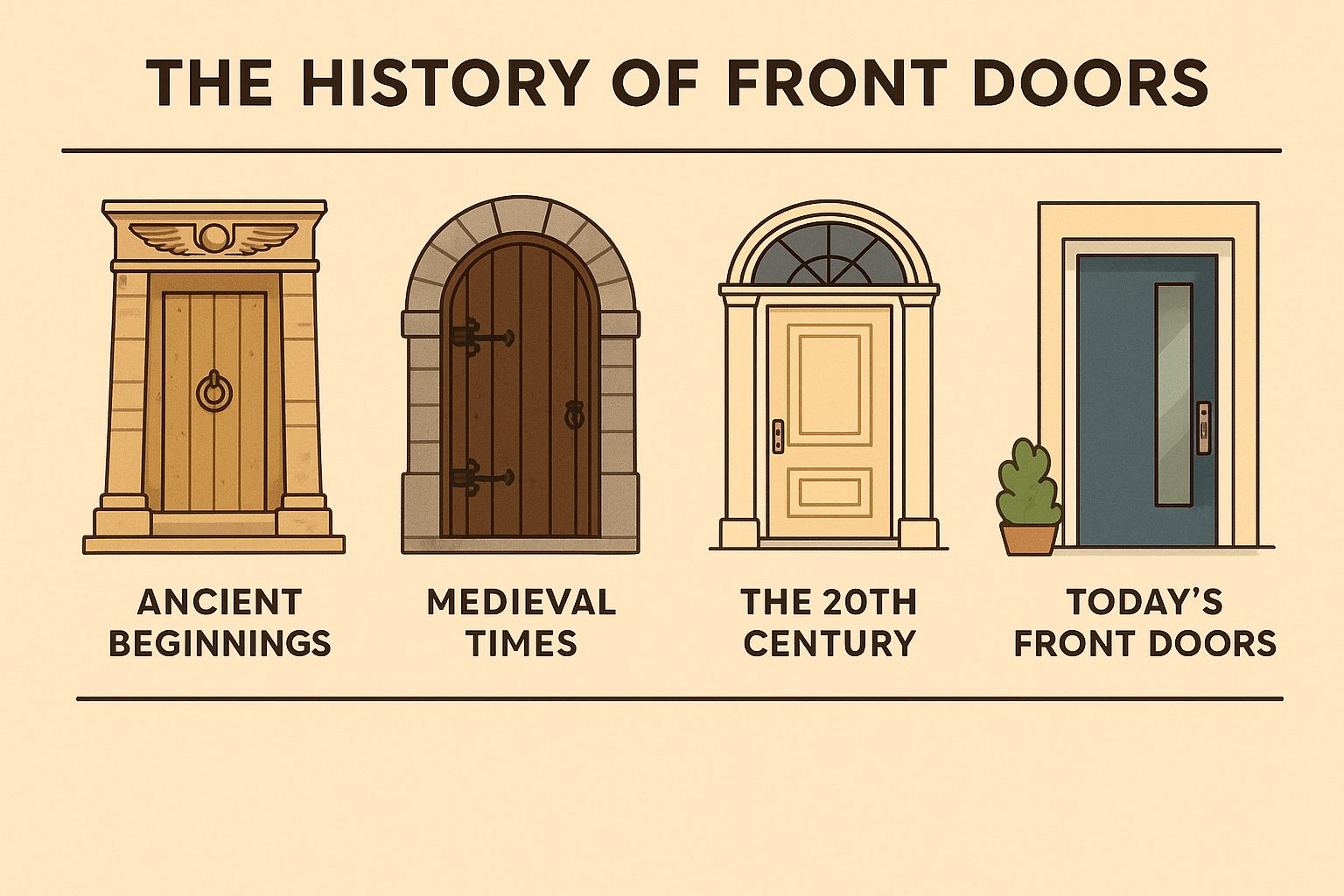

Ancient Beginnings: Protection and Power

The concept of a front door dates back to ancient civilizations such as Egypt, Mesopotamia, and Greece. Early doors were often made of wood, stone, or bronze, designed to keep out intruders and withstand harsh weather.

In ancient Egypt, grand temple doors were adorned with carvings of gods and symbols of protection. Similarly, Roman and Greek homes used wooden doors reinforced with iron to secure private courtyards. Doors weren’t just functional—they were spiritual, believed to guard the boundary between the human world and the divine.

Medieval Times: Strength and Status

During the Middle Ages, doors became fortresses in themselves. Castles and cathedrals across Europe featured massive oak doors bound with iron, often decorated with ornate hinges and studs. These doors symbolized power and security, announcing the wealth and status of those who lived behind them.

Church doors from this period often told stories—carvings depicted biblical scenes meant to educate a largely illiterate public. The “front door” became both a literal and symbolic gateway to safety and salvation.

The Renaissance and Beyond: Art Meets Architecture

As cities flourished and architecture became more refined during the Renaissance, front doors began to reflect artistic expression. Italian and French craftsmen designed elaborate wooden doors with detailed moldings and intricate carvings. Symmetry and proportion became important, aligning with the broader architectural principles of the era.

By the 18th and 19th centuries, colonial and Georgian homes brought these ideas to the New World. Painted wooden doors with glass transoms and sidelights allowed natural light to enter, balancing beauty with practicality.

The 20th Century: Functionality and Style

The Industrial Revolution introduced mass production, making decorative doors more accessible. Steel, aluminum, and fiberglass began to replace traditional wood, offering durability and affordability.

The mid-century modern movement simplified design—clean lines, minimal ornamentation, and bold colors became the trend. A red or turquoise door became a signature of optimism and individuality in postwar America.

Today’s Front Doors: Smart, Secure, and Stylish

In the 21st century, the front door continues to evolve with technology and design trends. Smart locks, video doorbells, and energy-efficient materials have redefined what a door can do. Homeowners now prioritize both curb appeal and security, choosing doors that blend craftsmanship with innovation.

From sleek contemporary designs to rustic farmhouse styles, today’s front doors reflect personality and lifestyle more than ever before.

Conclusion

The front door has come a long way—from ancient stone slabs to smart entry systems. It remains a symbol of welcome, safety, and self-expression. Whether you favor a historic look or a modern minimalist approach, your front door tells a story that’s thousands of years in the making.

Steve Cardinalli

Real Estate Professional, 01323509

(760) 814-0248

Steve@Cardinalli.com

www.Cardinalli.com

Century 21 Affiliated Fine Homes & Estates

Village Faire in Carlsbad Village

300 Carlsbad Village Dr, 223

Carlsbad, CA 92008

Be the first to know about the market trend in your community at Neighborhood News

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link